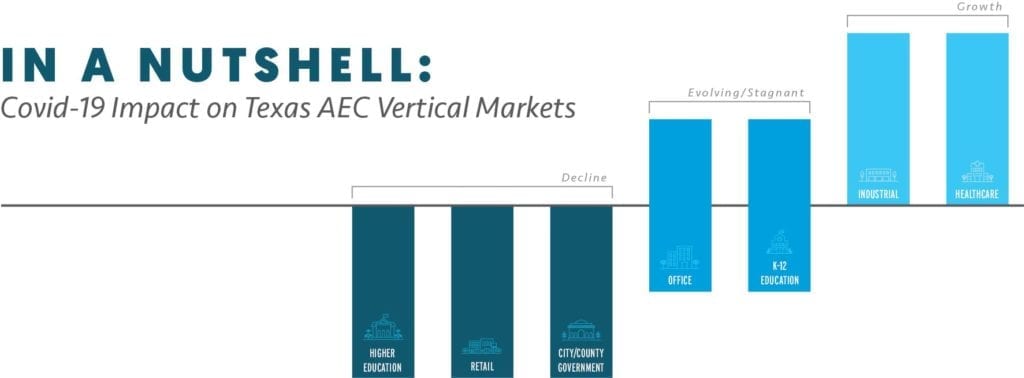

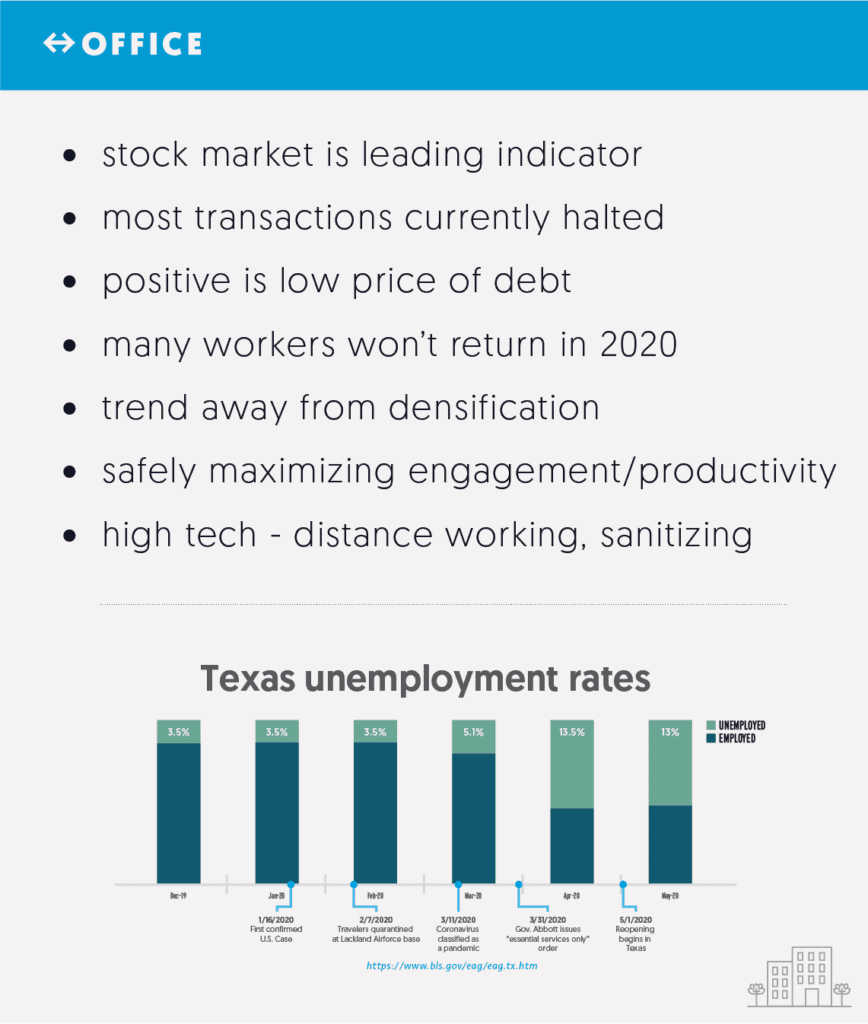

We looked at seven vertical markets where we build in the state of Texas to see how they’re being affected by the pandemic.

- Industrial

- Healthcare

- Office

- K-12 Education

- Higher Education

- Retail

- Municipal (City/County)

How is the landscape changing? What trends do we see as they relate to the AEC (architecture-engineering-construction) industry?

Here’s what the data said, and our two key takeaways.

The industrial and healthcare vertical markets are growing.

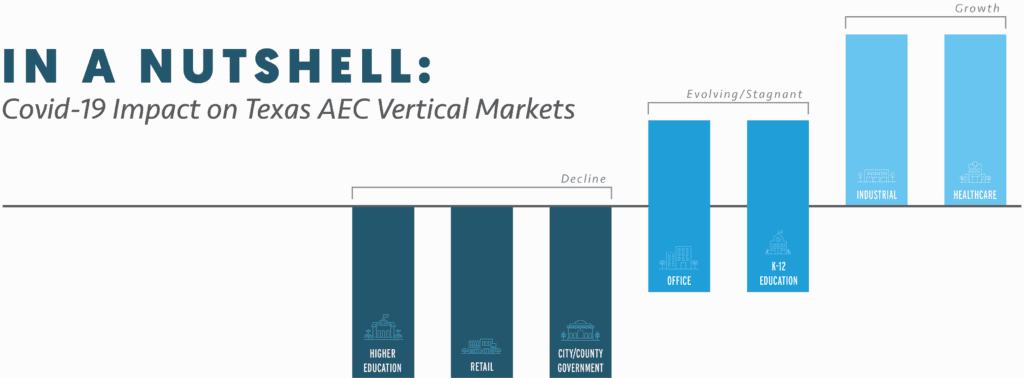

The healthcare industry is growing in unusual ways. Providing solutions to owners will be key.

There’s no doubt the Texas healthcare industry is in a state of flux during the pandemic. The entire AEC industry is anticipating new needs and concerns coming from owners as these medical community spaces are renovated and built in response to the challenges highlighted by the virus’ descent on our communities. These spaces include nursing homes, advancing surgical care centers, and high-tech clinics with special attention paid to the aging population and keeping people safe from those who are sick at a moment’s notice.

E-commerce activity during quarantine elevates need for industrial spaces.

E-commerce activity is leading to increase demand for warehouse space and industrial distribution, over 300 million square feet in Texas alone. Investment is way up in this market. Keep an eye on the US-Mexico-Canada agreement. It will play a role in the growth of the industrial vertical market.

The office and K-12 education vertical markets are evolving or stagnant.

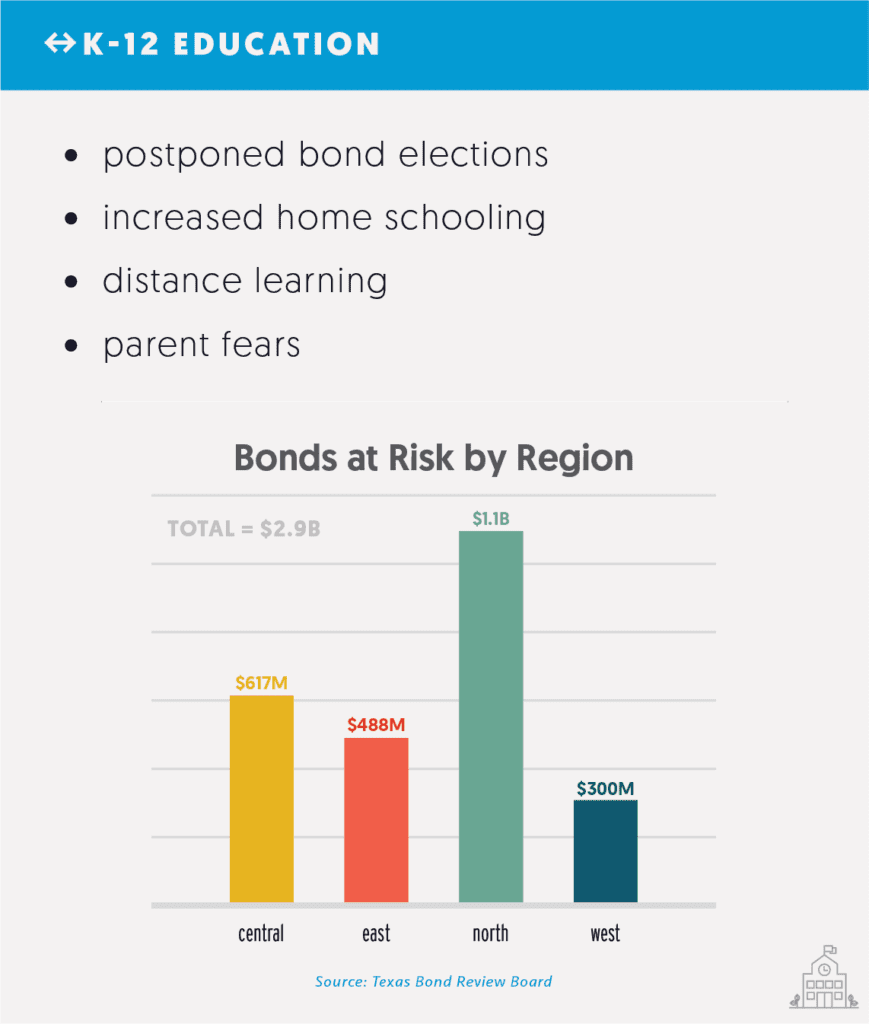

Reliable and consistent growth in the K-12 market is no longer a given.

In Texas, population growth will continue, but the passage of the education bonds to meet the needs of that population is not as certain. According to the Texas Bond Review Board, the total dollar value of at-risk bonds varies by region with North Texas carrying the largest at-risk bond value (West, $300M; East, $488M; Central $617M; North, $1.1B). Increased home schooling, parent fears, and distance learning will all come into play as new schools are being designed, built and renovated.

The most important thing we can do is stay in close communication with the campus administration and stay flexible. For our design team and owners’ reps, being available remotely has proven to be the most beneficial.

Janet Dusek, Joeris Project Manager

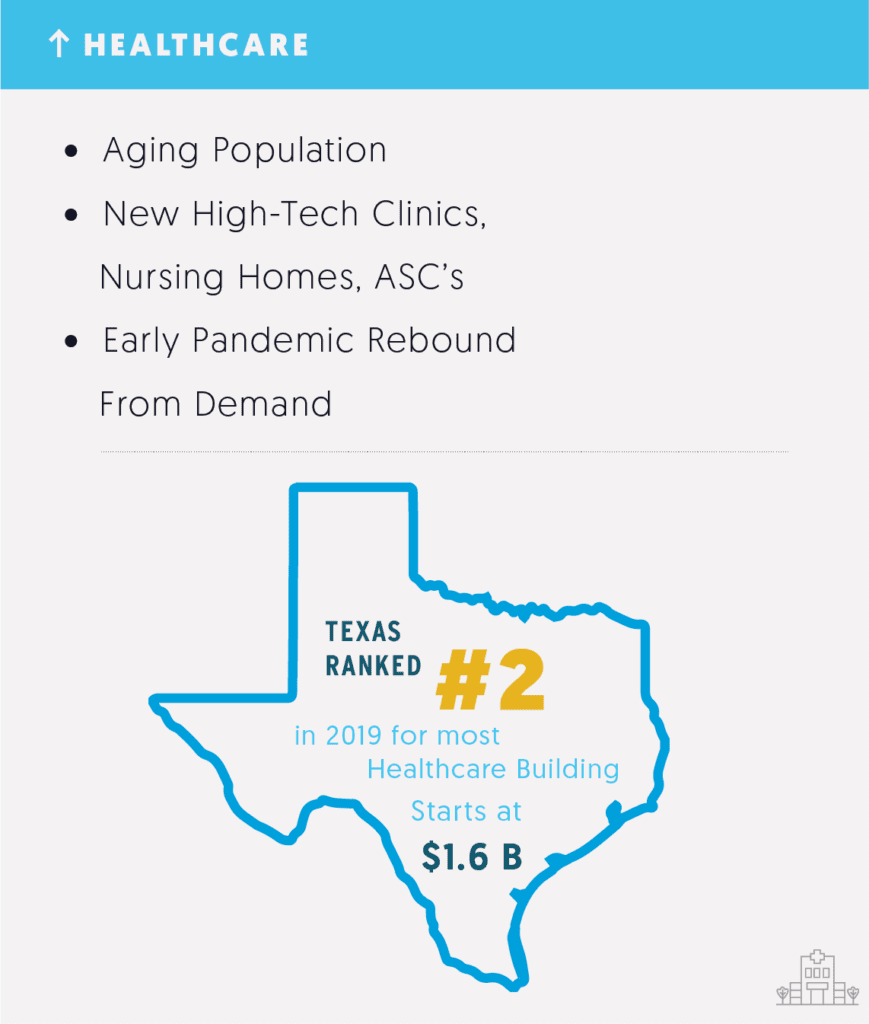

What will office space look like post-COVID? Our industry is a part of the conversation.

Workspace safety and how future offices will look during and after COVID are the topic of endless think piece articles by mainstream news outlets and are also a favorite for AEC industry publications. With the stock market as a leading indicator, most transactions on office constructions have been halted. A positive is the low price of debt. Like the healthcare market, we, as an AEC collective, will be looked to by owners for solutions and creative thinking as businesses move forward into the world post-COVID.

The higher education, retail and municipal vertical markets are in a decline.

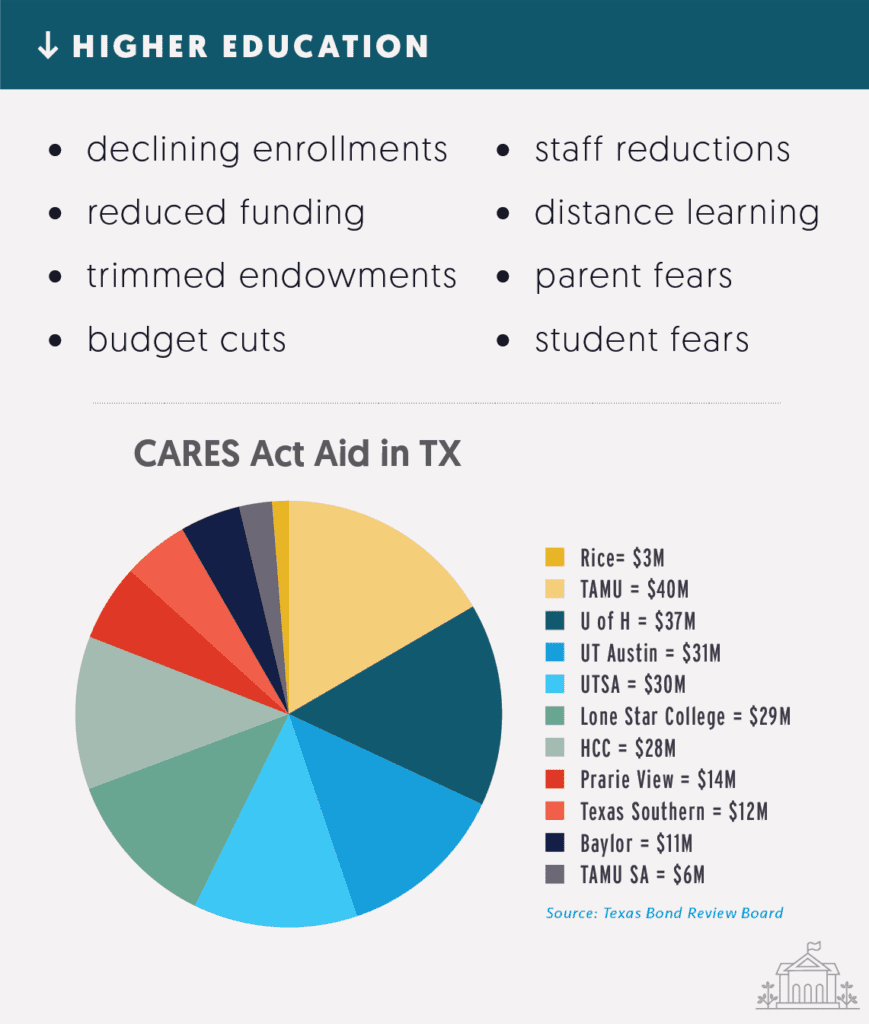

Higher education isn’t going to make the grade.

Declining enrollments, reduced funding, trimmed endowments, budget cuts, staff reductions, distance learning, and parent and student fears are all negatively affecting the growth patterns of higher education spaces. More so than in any other vertical market, COVID has initiated the expectation of a change in the status quo of how institutions function and, by extension, are designed and built to meet future needs. Pay close attention to how we can be of service to these owners in these troubling times.

The numbers show retail is in trouble. Grocery stores are a bright spot in the market.

Stores and malls are experiencing significant challenges during COVID. Sales are down 6% from 2019, over 25,000 stores will be closing in 2020, not to mention a rise in bankruptcies from retailers large to small. With high unemployment and the end of the COVID stimulus package in July, retailers expect to see continued customer drop off. According to CoreSight Research, there are a few areas of growth of retail space: grocery stores and stores that support online services or office needs.

Budget uncertainty makings planning for the future near impossible for local municipalities.

Capital projects have been put on hold as city, county, and government agencies work to understand the new landscape as it unfolds in front of them.

Simply put, I see no likely scenario under which the County will be able to budget for ‘business as usual’ for the upcoming year.

Bexar County Manager, David Smith

Planning, scheduling, and budgeting in advance are a key practice in the success and growth of our industry. Without that confidence in what to expect in the future, don’t expect to see much project movement in this sector. Reach out to your clients and see what questions you can help them with.

Key Takeaways

The AEC industry is in a unique position to help owners move forward, to be there to counsel them as they consider taking on the risk of a project and what that means for them.

Business owners want to be profitable, create jobs and spur local economic growth in communities. So, as architects, engineers, and construction managers we want to work with our clients to find the right building solution that fits their needs. They are thinking long-term, and we do too. This applies to all seven vertical markets that we reviewed.

Lead with integrity; Reach out to your fellow AEC partners with encouragement and support.

In our industry, we are all preparing ourselves for the unique work, or lack thereof, that lies ahead. During times of uncertainty, one thing that shouldn’t change is our determination to be of service to each other. You’re probably experiencing fierce competition for work that is out there. Now is the time your integrity should shine through. Remember to look ahead to your company’s future and remember that your brand is at stake. Come out on the other side of the COVID pandemic with the reputation of being knowledgeable, wise, and trustworthy by encouraging and working with other AEC firms who share in your values and help showcase the industry for the good that we do and the people we are.